Cheap finance deals

Finding the best car financing deals that are cheap finance deals can be challenge in todays market.

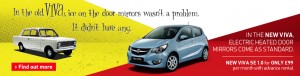

Cheap finance deals from Vauxhall The way manufacturers, dealerships and direct to market insurance houses make those offers is very different. Yet they all work along the same lines. To try and get you to buy their product. Scan any deal and you can currently get completely free insurance for a term, with and without deposit. Perhaps if not meeting the criteria and a young driver, receive free insurance with a one off payment. Or they will just hand you a lump sum to contribute to a frozen policy. All sounds great doesn’t it? Have you read the terms and conditions? We would advise all new car buyers to ensure they are receiving the proper and correct cover before signing any three year contract.

In insurance anything that ties you in for three years is probably not going to be the cheap finance deals with insurance that you thought it to be. Premiums do go up, but they also come down again. No matter how good that new car insurance offer is, compare cheap finance deals online for the best price. You also need to check the finer details to see if there are any exceptions for trade use. Employees and motor trade business owners can often put private cars under a single motor trade insurance policy document. This could also extend to family fleet. Are you still getting a cheap finance deal by going with the manufacturer’s or dealership’s insurance house or will you be paying out twice over?

Motor trade people are lucky in that they have Evans and Lewis at their beck and call. One question and your cheap finance deals will not only be matched but probably bettered. Don’t restrict your use of vehicles by getting into cheap finance deals that restrict your job mobility or use of the new vehicle you are buying. You’ll find everyone is trying to add a form of insurance to anything you buy these days. Remember, if in doubt call us to compare cheap finance deals with insurance and we’ll get a specialist underwriter to see if the offered deal can be bettered. Old cars, new cars, vehicles on lease, don’t sell your trade business operations short. Call today for the best insurance policies and lowest premiums because we don’t care which vehicle or fluffy dice you buy.