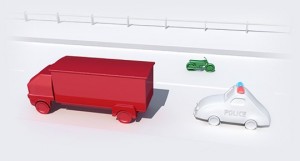

Motor Insurance database information from brokers helps motor traders to check if their vehicles are on the goverment system

Motor Insurance database information is accessible by everyone in the UK. Helping to ensure all motor trade vehicles are correctly insured and that info can be tracked as and when needed i.e. road speed cams. Truck owners, fleet running businesses and the police all have open access to minor details. More detailed information can be gleaned by authorities and insurers and info is retained for seven years. The point of access for the public is ASKMID.com and the entire service is run by Experian and allows you to see if your vehicles are listed. It’s an handy service as it can be used by those involved in accidents to check whether the named driver or a car involved in an accident is insured. Offering instant peace of mind at a worrying time.

https://youtu.be/6sMsBxXC80w

There is a fee for one off Motor Insurance database information access but those in the trade and other businesses needing to check more often can opt for a subscription. For instance, a motor trader offering vehicle breakdown services or roadside repairs may wish to check the validity of a vehicle’s insurance before buying a service. If you wish to check a vehicle you own as a company or individual, the service is free. Be warned that checking a vehicle that is not yours is an offence. The most costliest aspect of motor trade insurance and one which makes premiums higher for all in certain areas, is vehicles that are uninsured. Claims made against uninsured motor trade vehicles where funds are not reaped from an insurer’s pool payout equates to a loss. Use the Motor Insurance database information to protect your bits and bobs, and ensure your own vehicle information is up to date.

Motor Insurance database information is found at https://www.mib.org.uk/managing-insurance-data/the-motor-insurance-database-mid/

The stored information on Insurance database is the reason motor trade insurance brokers and insurance houses can deliver instant quotes so quickly. This is in no small part due to having access to multiple databases in regards to convictions and vehicle history. The MID being one of them. If you are searching the database and don’t find a particular vehicle listed, this could be one of many reasons. Your insurer didn’t update details which would be rare. The vehicle is still listed as off road and so called SORN. Or the vehicle is uninsured. While the vehicle owner doesn’t risk arrest, prosecution and the vehicle being seized and destroyed is. Out of the many tools a motor trading business could make use of, the Motor Insurance database information is certainly one to consider. As soon as a policy is on with us, we or partner insurers update your details on MID too.